Except you're a major govt in the C-suite, you are able to pretty much ignore remaining provided an NQDC plan. There's two primary styles: One seems like a 401(k) plan with wage deferrals and a company match, and the other is exclusively funded because of the employer.

NerdWallet's scores are determined by our editorial staff. The scoring components for on the internet brokers and robo-advisors will take into account about fifteen things, which include account costs and minimums, expenditure options, shopper guidance and mobile application abilities.

You will discover many styles: full existence, variable everyday living, common everyday living and variable common existence. They provide a Demise reward while simultaneously developing hard cash worth, which could guidance your retirement needs.

Diversification may be the follow of spreading your investments all-around so that the exposure to Anyone variety of asset is restricted. This apply is built to assistance reduce the volatility of your portfolio after some time.

In the not likely party of Citi suffering economic distress, your assets could well be allocated to you as being the helpful operator.

The profit is It can save you dollars over a tax-deferred basis, although the employer won't be able to have a tax deduction for its contribution until you start spending money tax on withdrawals.

Other components, which include our personal proprietary Web page procedures and no matter whether a product is obtainable in your neighborhood or at your self-chosen credit rating rating array, could also effect how and exactly where products show up on This web site. Whilst we attempt to provide a wide array of provides, Bankrate would not involve specifics of just about every economic or credit history products or services.

A lot of, or all, from the products featured on this page are from our marketing partners who compensate us whenever you consider specified actions on our Web page or click on to just take an action on their website.

Like all IRAs, you’ll have to have to choose how to take a position the money, and that may cause troubles for a number of people. You should spend Specific consideration to any tax effects for rolling about your cash, mainly because they is often significant.

These accounts turn into even more flexible while you age. After you strike age sixty five, any cash from the account may be withdrawn and useful for any reason — not only medical costs — without having a penalty, however you’ll owe taxes around the withdrawal at ordinary profits premiums. This element would make the HSA operate like a traditional IRA, if held to age 65.

A lot of personnel have the two a 401(k) plan and an IRA at their disposal, offering them two tax-advantaged strategies to save lots of for retirement. Even If you cannot afford to pay for to max out both equally kinds click over here of accounts, you'll find approaches to ensure you get the most Advantages from Each individual.

You will be obtaining bond-like returns so you reduce the opportunity of getting higher returns in the inventory sector in Trade for the certain profits. Considering the fact that payments are for all times, In addition, you get a lot more payments (and an improved In general return) if you live extended.

These best robo advisors charge lower service fees but still offer you high-good quality options, which includes automated portfolio rebalancing, publicity to a range of asset lessons and economic planning applications. Some also offer you entry to money advisors.

Various financial investment solutions: Compared with a Website normal firm-administered retirement plan, these plans may possibly let you invest in a broader array of assets.

Charlie Korsmo Then & Now!

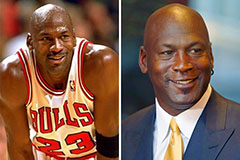

Charlie Korsmo Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!