With Equity Trust, you may open up the retirement account within your option—together with further account kinds like Coverdell Discounts and overall health discounts accounts. At the time your account is open up and funded, you may take a look at 10 different precious metals dealers by means of their Investment District.

Our partners can't pay out us to ensure favorable testimonials in their items or solutions. Here's an index of our partners.

It’s worthy of noting that SDIRAs place you in the driver’s seat. Custodians can’t offer monetary information. This prohibition deters numerous financial institutions and brokerage firms from offering SDIRAs. This leaves the duty squarely on the shoulders to research and strategize your investments.

If your IRA is issue to essential minimal distributions (RMDs), you’ll must program far ahead to make sure you can liquidate assets to meet your RMD obligations.

Investing in gold and silver needs assessing marketplace trends, storage prices, and financial components. Gold is frequently deemed a safe haven all through financial downturns, though silver is usually additional unstable. Comprehending these factors is very important ahead of investing.

Whilst Alto delivers a regular self-directed IRA for assets like real estate and art, their copyright self-directed IRA is essential-review for followers of digital assets.

Before opening a self-directed IRA, take into consideration day-to-day brokerage-based More Info IRAs additional hints 1st. Not just will you probably have much much less costs and transaction prices. You’ll also have access to various non-conventional asset lessons by way of pooled investments like mutual cash and ETFs.

Alana Benson is undoubtedly an investing author who joined NerdWallet in 2019. She handles a wide variety of investing matters including stocks, socially responsible why not find out more investing, copyright, mutual cash, HSAs and fiscal information. She is additionally a Recurrent contributor to NerdWallet's "Wise Cash" podcast.

will be the 1 accountable for picking and handling the investments you have got inside of your account. That’s why you usually gained’t come across self-directed IRAs provided at most classic brokerage companies and banking companies that offer typical IRAs. As an alternative, you will find investment firms available that focus on self-directed IRAs and could work as a custodian for your account.

Other popular solutions contain purchasing futures contracts for a selected steel or obtaining shares in publicly traded companies engaged within the exploration or production of precious metals.

Nonetheless, selected custodians are willing to administer accounts Keeping alternate investments and to supply the account owner with major Management to ascertain or "self-direct" Those people investments, issue to prohibitions founded by tax rules.

The account have to be governed by prepared Guidelines and fulfill specific demands associated with contributions, distributions, holdings, and also the id from the trustee or custodian.

Tangible asset: Precious metals are actual assets that keep worth further than investment purposes for example jewellery or industrial employs.

Taxes SDIRAs Keep to the very same tax rules on investment advancement as common and Roth IRAs. But SDIRAs have added rules of their very own. If those rules are not followed, the IRS considers the account as owning ceased to function being an IRA.

Gia Lopez Then & Now!

Gia Lopez Then & Now! Karyn Parsons Then & Now!

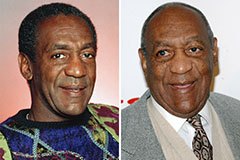

Karyn Parsons Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!